Six important questions to ask if you're under 30 and trying to get ahead financially

It’s clear, Australia is part of a global economic transition where technological, social and political disruption are dramatically changing entire industries, products, services and jobs. For those considering their future career or graduating from university or with a few years of job experience, navigating the resulting challenges and opportunities will play a big role in future happiness and success.

Is it getting harder to save and invest?

When I talk to clients and others in their 20s and early 30s about how to get ahead in the midst of this economic transformation, they often say something like, “my parents' generation bought all the houses and now I’ll never be able to afford to get into the market.” What they may not consider is many of their parents bought their first home in the 80s when interest rates reached 17% and then struggled again with mortgage payments during the recession of the 1990s, until a period of growth returned in the nineties. The truth is building wealth has always taken sacrifice, and commitment. That, said this generation does face some extra headwinds which make it harder.

When I talk to clients and others in their 20s and early 30s about how to get ahead in the midst of this economic transformation, they often say something like, “my parents' generation bought all the houses and now I’ll never be able to afford to get into the market.” What they may not consider is many of their parents bought their first home in the 80s when interest rates reached 17% and then struggled again with mortgage payments during the recession of the 1990s, until a period of growth returned in the nineties. The truth is building wealth has always taken sacrifice, and commitment. That, said this generation does face some extra headwinds which make it harder.

The average baby boomer may not have had much money when they bought their first property, but some did have free university education and could look forward to a steady income once in the workforce. In contrast, today’s university graduates are emerging with debt, sporadic work income and uncertain future prospects – granted, it’s not the ideal circumstance for creating a saving and investing habit. This combination of forces seem to be contributing to a ‘you only live once’ mentality to spending and a ‘what’s the point’ attitude to saving and investing. While understandable, I believe this approach is a real threat to our kids' futures. Especially as their parents will live longer lives than ever before and are likely to spend the inheritance in the process!

How can I get started?

If you’re under 30 and earning a decent income – regular or sporadic - my suggestion is to get good advice and get started. Sound savings and investment strategies will grow over time despite the turmoil you may be experiencing in the first decade of working life. Even modest top-ups to super now will make a big difference to how you live later. Think of your financial life like a duck on the water, you can build wealth gradually and gracefully, even if your career is more like the feet paddling furiously underneath. And there’s no guarantee career turmoil will ease in the future, so what are you waiting for?

How can I deal with uncertain income?

Budgets are never popular, but they’re essential for coping with fluctuating income from sporadic, part-time or contract work. It’s easy to budget for your best month and be caught short when you hit a low patch. Ideally budget for your minimum pay-packet based on the previous 12 months and avoid spending up big when a good month comes. Put the extra money into your savings or investment plan and imagine the goals you can achieve when it grows into a deposit for a house or business. If you’re in a relationship and one partner has a more steady income, try to live off that and save all of the sporadic income. This can be a great way to get ahead. Budgeting doesn’t have to mean boring spreadsheets. Try quick and easy apps like Pocketbook or Mint which will keep you on track and alert you to overspending.

Budgets are never popular, but they’re essential for coping with fluctuating income from sporadic, part-time or contract work. It’s easy to budget for your best month and be caught short when you hit a low patch. Ideally budget for your minimum pay-packet based on the previous 12 months and avoid spending up big when a good month comes. Put the extra money into your savings or investment plan and imagine the goals you can achieve when it grows into a deposit for a house or business. If you’re in a relationship and one partner has a more steady income, try to live off that and save all of the sporadic income. This can be a great way to get ahead. Budgeting doesn’t have to mean boring spreadsheets. Try quick and easy apps like Pocketbook or Mint which will keep you on track and alert you to overspending.

What assets should I consider?

Buying a house may once have been the Australian dream but the GFC, stagnant wages and low interest rates making it hard to save have led many under 30 to believe it’s out of their reach. However, property still plays an important role in a long-term investment strategy. It’s not so much the asset that needs to change, but its characteristics: rather than focusing on a home to live in, you might buy an investment property in one of outer suburban growth corridors, and put the income towards renting in an inner suburb that provides the lifestyle options you want. Ultimately, it’s about getting a foothold in the market to benefit from future capital growth. For those who remain sceptical about property, renting while buying a regular tranche of shares or considering negative gearing to invest in shares, could be a better alternative than putting savings in the banks, given low interest rates. Sit down with an experienced adviser and do the math before getting started, but take some action to build wealth.

How can I improve my chances of career success and better income?

Knowing where to focus your education and training to improve future job prospects is a key question. Digital disruption and smart machines are having a huge impact on business. The people I’ve noticed who are doing well, particularly in the digital environment, are focusing on jobs people need to get done in increasingly time poor families where all adults work. The success of start-ups like Airtasker, Hello Fresh and Uber are proof of the demand for businesses who can fulfil every day, time-saving tasks.

What skills will I need to thrive?

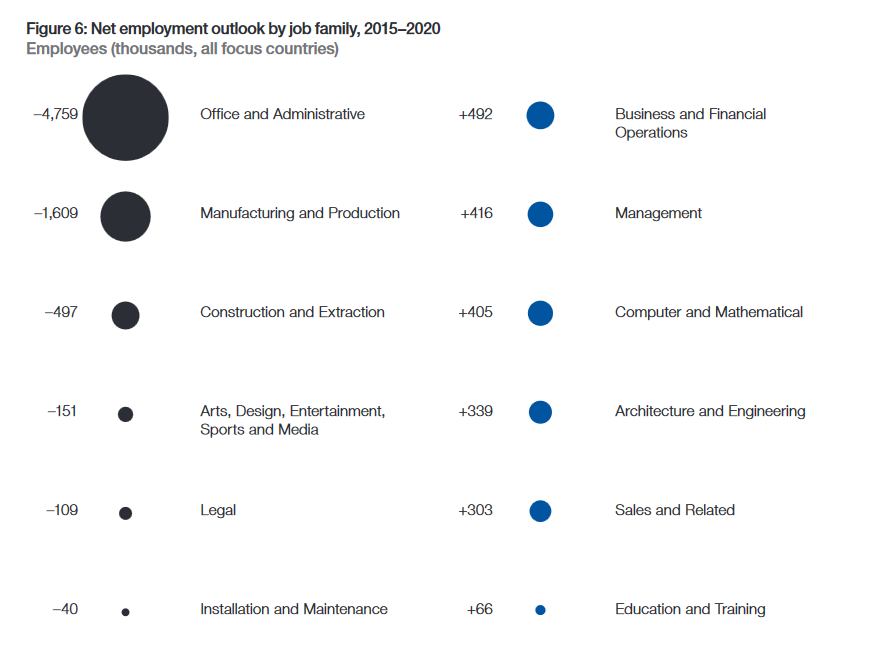

Disruption to business models in diverse industries from manufacturing to leisure and media is causing significant job upheaval. Change will see millions of current jobs disappear and millions more new jobs created. Jobs with a high-level of repetitive administration that can be automated by technology will be the first to go. For decades it has been desirable to have a bachelor degree as a stepping stone to a professional career. But if entry-level jobs are the first to go in areas like law and business management, then post graduate degrees may soon become the new ‘entry-level’ and getting paid work experience may continue to be a challenge. If you’re thinking about study or career options, consider these numbers from the World Economic Forum’s Future of Jobs, where Australia was one of the focus countries).

This means new professional jobs will be more knowledge-based and require both specialist technical skills and well-rounded soft skills. A colleague of mine, Organisational Psychologist Michelle Cieciura, believes there will be more opportunities for people with strong self-awareness, particularly as they seek leadership responsibilities. “For example, data analysts will be in great demand and while their core disciplines are statistics and mathematics, candidates will be expected to have strong interpersonal and influencing skills. Similarly, those with strong communication and presentation skills will be in demand in sales, marketing and education; but will need digital acumen and the ability to analyse and utilise data.” says Michelle.

Of course the WEF report focuses on commercial jobs, but we can also expect many more jobs in agriculture, leisure, hospitality and tourism as the growing middle class in fast-growing neighbouring countries invest in the Aussie food bowl and look for new travel experiences. The same goes for building trades, where the supply of talent falls well short of demand and where financial rewards can be impressive. Now is a good time to consider how some of these career paths many fit with your own talents to future-proof you career.

What you can do now

A sense of overwhelm is natural when making big life decisions about education, your career or financial future in uncertain times. My advice is to think carefully about your career and lifestyle goals and decide where you’re going to focus your time and energy. Your earning potential is your greatest asset early in life so saving or investing now will get you ahead of the pack thanks to the power of compounding and the tendency for investments to perform best over longer periods of time.

If you or anyone you know could benefit from some advice, I’d be happy to have a chat.